How much does an employee cost in Spain? (includes calculator)

One of the main concerns for foreign businessman who intend to establish a company in Spain is how much does an employee cost in Spain, ie, what is the monthly amount of tax to be paid to the Social Security for each worker. At the end of this post you will find a cost of hiring an employee calculator.

Likewise, briefly understanding the operation of the Spanish labour contribution system to the Social Security can provide more security in the decision process of creating or expanding a business to Spain.

Contribution to the Social Security

All employee residing in Spain, whether self employed or employee of a company, is obliged to contribute to the Spanish Social Security by paying taxes from their salary. Likewise, any company that has employees must contribute through taxes to support the Spanish Social Security.

The Social Security contribution is made by paying a monthly contribution calculated by applying a percentage to the salary of the employee; the so called contribution base.

In the calculated contribution there is a part corresponding to the worker and another to the company. The contribution is paid even when the worker is in sick leave or vacation.

The company is responsible for paying the monthly payments to the Social Security. For it it will withheld the worker’s part, calculate the part of the company and pay both amounts to the Social Security. Although the payment of the monthly contribution is unified to the General Treasury of the Social Security, not all the amount is intended for Social Security; There is also a small portion for vocational education and training for workers, one for unemployment and another for the wage guarantee fund.

For self employed, the Social Security calculates and charges a monthly contribution that is directly related to the contribution base chosen by the self employed.

The company is responsible for the payment of contributions to the Social Security and can be fined if the payment is not done or done after the deadline. However, if the company will be able to pay the contribution to the Social Security, it can request a payment deferment.

Except in exceptional cases, the monthly payment must be made within the next month of accrual, ie the following month after which the payslips have been generated. In contrast, in the case of self employed, the payment is made in the same month of accrual.

How to calculate the monthly contribution and how much does an employee cost a company.

As stated above the contribution to the Social Security is done by paying a monthly contribution calculated applying a percentage to the salary of the employee.

The base used to calculate the contributions consists of the total remuneration received by the employee, including part of extra payments that would correspond to a month of work, and the payments in kind. However, there is a very limited list of items that are not included in the contribution base, as travel expenses, death compensations, etc.

The contribution base is divided into several concepts before applying the tax rate, namely:

Common contingencies contribution base

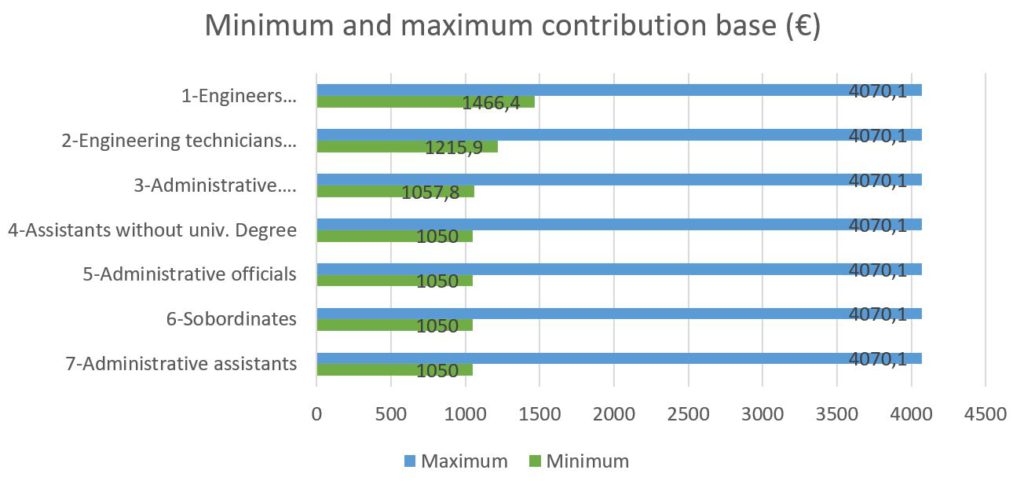

The bases are formed by the salaries of the company employees grouped according to their professional category. For each group there is a minimum and maximum base. Excesses in the maximum base are contribution tax exempt.

Contribution bases for common contingencies

| Generator Set | Occupational Classification | Minimum Base | Maximum Base |

| 1 | Engineers and University Graduates | 1466.40 | 4070.10 |

| 2 | Engineering Technicians, Experts and Qualified Technicians | 1215.90 | 4070.10 |

| 3 | Administrative and workshop managers | 1057.80 | 4070.10 |

| 4 | Assistants without a University Degree | 1050.00 | 4070.10 |

| 5 | Administrative Officials | 1050.00 | 4070.10 |

| 6 | Subordinates | 1050.00 | 4070.10 |

| 7 | Administrative Assistants | 1050.00 | 4070.10 |

Professional contingencies contribution base

Workers are not grouped by professional category but merely the minimum and maximum base applies to all employees of the company.

Maximum and minimum basis for professional contingencies are the same as for common contingencies.

Other concepts

These are intended for unemployment, Wage Guarantee Fund and vocational education and training. To calculate this contribution the same basis is used as for professional contingencies.

Contribution rates and labour costs

To the contribution bases described above a given percentage called contribution rate is applied as follows in order to know what is the employee cost to company and the employee contribution.

| Contingencies | Company contribution (%) | Employee contribution (%) | Total contribution(%) |

| Common contingencies | 23.60 | 4.70 | 28.30 |

| Unemployment | 5.50 | 1.55 | 7.05 |

| Wage Guarantee Fund | 0.20 | 0.00 | 0.20 |

| Vocational education and training | 0, 60 | 0.10 | 0.70 |

| Professional contingencies (depends on the type of activity – CNAE) | – | – | – |

| Total | 29.90 | 6.35 | 36.25 |

Note:

In temporary contracts of effective duration of less than seven days, the employer contribution for common contingencies is increased by 40 percent. It does not apply to interim contracts, or the Special System for Agricultural Workers included in the General Regime.

Also there may be reductions in these rates for certain labor contracts, hiring people with disabilities, etc.

For professional contingencies the percentage that corresponds according to the activity of the company is applied. For that purpose the rate linked to the National Code of Economic Activities (CNAE) of the company must be applied: table of contributions for professional contingencies

Example: how to calculate Social Security contributions for an employee in Spain. Employee cost.

What is the Social Security cost for a company dedicated to technical services architecture (CNAE 71) with one employee who earns a gross salary of 2000 euros per month plus two extra payments of 2000 euros in June and December?

The contribution base will consist of the salary plus the proportion of extra payments in June and December, ie: 2000 + (4000/12) = 2333.33 euros

Thus the cost of social security for the company is 736.17 euros and 148.17 euros for the employee, which will be deducted from his payslip.

Cases of variation in contribution costs.

In certain cases the contribution rates are not the same as usual. These cases include among others, temporary disability, maternity, back payments, etc.

Temporary contracts

short term contracts of less than seven days duration, the company’s contribution for common contingencies will increase by 36% (not applicable to interim contracts or agricultural workers)

Back payments

wages that are paid retroactively will be taxed through an additional declaration taking into account the bases, limits and rates of the month to which the salary corresponds.

Not taxed extra payments

In the case that any extra payment was not possibly foreseeable, it will be taxed through an additional declaration taking into account the bases, limits and rates of the current month.

Incapacity and pregnancy

Different rules for calculating the contribution bases are applicable. In general, the base of the previous month to the incapacity or pregnancy is applied.

Reimbursement of holidays not taken

When for dismissal cause a not taken holiday is pain, the payments will be taxed through an additional declaration taking into account the bases, limits and rates of the month of termination of the employment contract.

Procedural salaries

When an employee receives salaries following a dismissal, the amounts paid will be taxed by the last day of the month following the notification of the judgment or conciliation procedure.

How to settle and pay Social Security contributions

Settlement and payment of contributions to the Social Security is done through the system of direct settlement which is managed through the RED System (Sistema de Remisión Electrónica de Datos) and paid by direct debit.

The direct settlement system is called SILTRA system. In such system the Social Security is who calculates the contribution of each worker.

Companies must notify to the Social Security the data changes produced in each period so that it can calculate the tax liability for each worker.

The deadline for information submission is until 23: 59h of the penultimate day of the month and the payment must be done by the end of the month, although, in case you want to receive a direct debit the information must be sent by the 24th of the month.

Cost of hiring an employee in Spain calculator

I have prepared this simple employee cost calculator so you can know how much does an employee cost in Spain.

Bear in mind that this is just a informative employee cost calculator. Results can vary depending on the type of contract and the type of activity of the company.

As explained above, the maximum base is 4070,10 time 12 months so, when gross salaries are above EUR 48841.20, the cost stabilizes.

Payroll services in Spain

Contact Now !